Investing in a systematic investment plan is a simple and convenient way to invest in mutual funds. To start an SIP, you will need to choose a mutual fund and fill out the necessary paperwork. Once your account is set up, you can decide how much and how often you want to invest (e.g., weekly, monthly). The money will then be automatically deducted from your bank account and invested in the mutual fund. SIPs are a great way to invest a small amount of money regularly and benefit from the power of compounding over time. It’s also a good way to invest for long-term goals such as retirement, education, and more.

What is SIP?

A Systematic Investment Plan is a way to invest in mutual funds by regularly setting aside a fixed amount of money at a fixed interval, usually monthly. It allows an investor to invest a small amount at regular intervals instead of a lump sum. The money is automatically deducted from the investor’s bank account and invested in the chosen mutual fund. SIPs are a convenient and disciplined way to invest, and the power of compounding over time can help to grow your investments significantly. It’s a popular choice for long-term investment goals such as retirement, education, and wealth creation.

Three Main Types of SIPs:

- Fixed SIP: In a fixed SIP, the investor invests a fixed amount of money at a fixed interval, usually monthly.

- Flexi SIP: A flexi SIP allows the investor to change the amount of money invested at each interval. This can be useful for investors who have a fluctuating income or want to adjust their investment amount based on market conditions.

- Step-up SIP: A step-up systematic investment plan allows the investor to increase the investment amount at a pre-determined interval. This is a good option for investors who want to increase their investment over time to take advantage of the power of compounding.

Why Should You Invest In A SIP?

There are several reasons why you should consider investing in a systematic investment plan:

- Convenience: SIPs allow you to invest small amounts at regular intervals, making it easy to invest even if you have a limited budget.

- Rupee Cost Averaging: SIPs help to reduce the risk of investing a lump sum by averaging out the cost of investments over time. This is known as Rupee cost averaging, which helps to smooth out the impact of market fluctuations on your investments.

- Power of Compounding: The regular investments in systematic investment plan over a period of time will grow exponentially, this is due to the power of compounding.

- Flexibility: SIPs allow you to invest in a wide range of mutual funds, giving you the flexibility to choose a fund that aligns with your investment goals.

- Low-Cost: SIPs are a low-cost way to invest in mutual funds, as they usually have lower minimum investment amounts and lower charges than lump sum investments.

- Tax Advantages: systematic investment plan investments are eligible for tax benefits under Section 80C of the Income Tax Act.

In a nutshell, SIP is a convenient, disciplined, and cost-effective way to invest in mutual funds, suitable for long-term financial goals such as retirement, education, and wealth creation.

How to calculate my SIP Amount?

To calculate your SIP amount, you will need to consider several factors:

- Investment Goal: Determine how much money you need to achieve your investment goal. This will give you an idea of how much you need to invest and for how long.

- Time Horizon: Consider the time horizon for your investment. The longer the time horizon, the more you can invest each month.

- Risk Tolerance: Assess your risk tolerance and choose an investment option that aligns with your risk profile.

- Monthly Budget: Evaluate your monthly budget and set aside an amount for your systematic investment plan investment. Make sure the SIP amount is affordable and does not strain your finances.

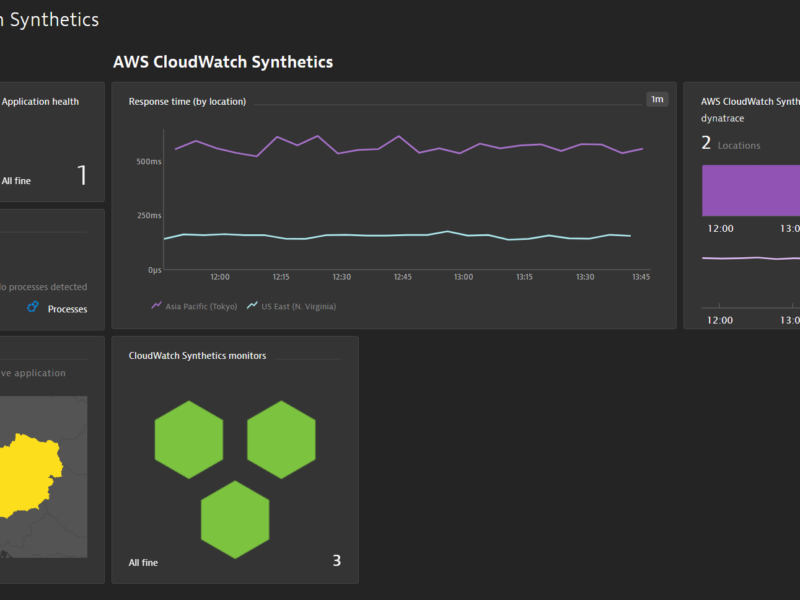

- Compounding Interest: Use a compound interest calculator to estimate the returns on your systematic investment plan investment based on the amount, frequency, and duration of your investment.

Once you have determined your investment goal, time horizon, risk tolerance, and monthly budget, you can use a SIP calculator to estimate your SIP amount. A SIP calculator takes into account the amount, frequency, and duration of your investment, as well as the expected rate of return, to give you an estimate of your SIP amount.

It’s always a good idea to consult a financial advisor before starting a SIP, to ensure that it’s the right investment choice for you and to help you to determine the best SIP amount for your needs and goals.